Embarking on a journey to acquire a business is as exciting as it is daunting. With various factors to consider, having a well-structured checklist can make all the difference. In this blog post, we’ll simplify the complex process of business acquisition into 20 crucial steps to ensure a smart and seamless purchase. Let’s get started on setting the stage for your success.

1. Understanding Your Acquisition Goals

Before diving into the acquisition process, it’s essential to clarify your objectives. Understanding why you want to acquire this particular business will guide your decisions and strategies throughout the journey. Consider what you hope to achieve—whether it’s diversifying your current portfolio, entering a new market, or leveraging a competitive advantage.

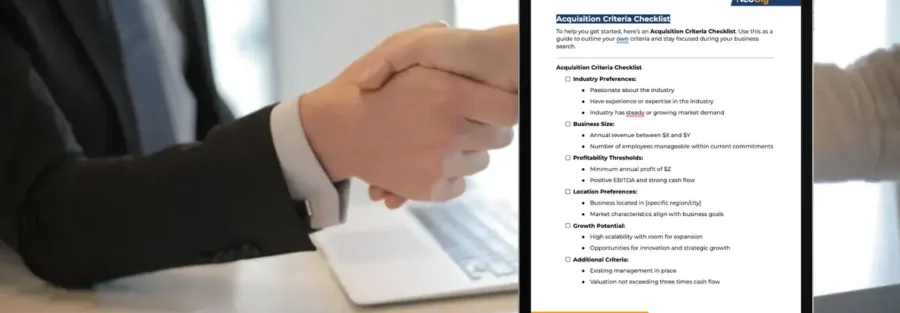

Creating an acquisition plan tailored to your specific needs lays a strong foundation for the entire process. Take time to define both short-term and long-term goals. With clear targets in mind, you can better evaluate potential acquisitions, ensuring alignment with your broader business strategy. For expert guidance on business planning, explore more here.

2. Researching the Market Landscape

A deep dive into the market landscape will help identify potential opportunities and challenges. Knowing the industry trends, competitors, and potential customer base allows you to make more informed choices. Use tools such as SWOT analysis to assess strengths, weaknesses, opportunities, and threats within the market. This will position you to navigate expected hurdles or capitalize on market gaps.

Begin by reviewing market reports and industry publications. This wealth of information can provide invaluable insights into factors like emerging trends and competitive dynamics. Consulting experts can further illuminate changes that might affect your target business’s market positioning. Overall, solid market research helps you establish realistic expectations and set quantifiable targets for success.

3. Identifying and Selecting Potential Targets

Finding the right business to acquire is critical. This involves exploring different companies that align with your goals, offering the potential for growth and synergy with your existing operations. Engaging with business brokers or utilizing mergers and acquisitions (M&A) platforms can streamline this search process by connecting you with businesses that fit your criteria.

Using a systematic approach in your selection process will ensure that you consider various factors such as the target’s scalability, cultural fit, and strategic value. Non-financial aspects can sometimes hold equal, if not more, importance than financial metrics. As John Geiwitz outlines in his 20-step process, choosing the right target is as much an art as it is a science.

4. Conducting Preliminary Due Diligence

Initial due diligence entails a high-level review of potential acquisition targets. Gathering basic financial, operational, and legal information helps you narrow down the most viable candidates. Vital documents typically include financial statements, tax returns, legal compliance records, and market analysis reports.

In its early stages, due diligence acts as a filter to identify red flags or confirm initial impressions. Notably, in-depth due diligence comes later, but laying the groundwork here aids in focusing future efforts. For a structured approach, reference this comprehensive checklist on due diligence from Axiom Law.

5. Engaging with Legal and Financial Advisors

Having expert advisors is invaluable. Their insights and guidance on legal, financial, and operational matters ensure you navigate the acquisition process smoothly and avoid potential pitfalls. Experienced advisors can provide a fresh, unbiased view that can be instrumental in making objective decisions.

Legal experts assess regulatory compliance, draft agreements, and review legal obligations, while financial advisors evaluate financial health and tax implications. Building a skilled advisory team contributes significantly to risk mitigation throughout the acquisition journey. For those preparing to sell, a due diligence checklist can also help ensure readiness and transparency.

6. Evaluating Financial Health

Analyzing the financial stability and performance of the target company is non-negotiable. Examination of financial statements, cash flow, and profitability forecasts reveals the viability of the investment. This ensures that the business aligns with your risk tolerance and profitability expectations.

Engage in financial due diligence, involving assessment of historical earnings, revenue trends, and working capital needs. A meticulous approach helps verify the company’s financial narrative. Consider potential contingencies that may affect future cash flows and profitability. Both risks and opportunities must be accounted for, simultaneously bolstering informed negotiations on valuation and terms.

7. Assessing Operational Synergies

Understanding how the target company’s operations align with yours is crucial. High synergy potential can lead to cost savings and increased competitive advantage post-acquisition. Look at areas such as product development, supply chain efficiencies, and core competencies for potential integration.

Streamlining processes post-acquisition can also foster innovation and promulgate best practices across both entities. Thus, structuring an operations integration plan is advisable early on. Leveraging inter-organizational synergies can exponentially elevate both entities’ performance, positioning you more robustly in the marketplace.

8. Negotiating Terms and Valuation

Once a preferred target is determined, negotiations begin. Agreeing on a fair valuation and favorable terms ensures both parties achieve their desired outcomes, paving the way for a successful deal. Valuation takes into account numerous factors—ranging from financial metrics to market positioning and strategic assets.

During negotiations, it’s also vital to cover contingencies, buyout terms, and any post-acquisition commitments that the seller must fulfill. Some common negotiation tools include earn-outs, seller financing, and non-compete clauses. A thorough checklist can help you structure these terms effectively, as noted by experts at SmartRoom.

Ready to take the next step? Grab our free business acquisition checklist athttps://ejbowen.com/free-resources/and start planning your successful acquisition today!