✍️ Introduction: The Challenge of Efficient Business Evaluation

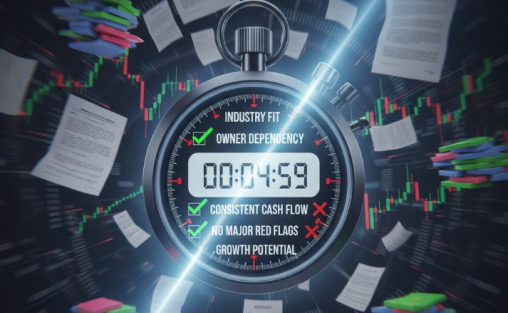

For aspiring business owners, sifting through potential acquisitions can feel overwhelming. Endless financial statements, operational data, and industry research can make even the savviest professionals hesitate. That’s where a quick deal review comes in: a method to evaluate a business in under five minutes and identify whether it’s worth a deeper dive.

Image alt text suggestion: Founder using a checklist to quickly evaluate a business deal

📚 The 5-Minute Business Evaluation Method

EJ Bowen’s business evaluation method is designed for speed without sacrificing insight. Here’s a step-by-step framework:

1. Quick Filters

- Industry Fit: Is the business in a sector you understand or are excited about?

- Size & Revenue: Does the scale match your financial and operational capabilities?

- Owner Dependency: Can it run without the current owner?

2. Red Flags

- Sudden revenue drops

- Unusually high churn

- Pending legal or regulatory issues

3. Financial Cues

- Consistent cashflow over 12–24 months

- Reasonable profit margins

- Transparent and clean bookkeeping

4. Industry Checks

- Market growth trends

- Competitor landscape

- Customer base stability

5. Deal-Breaker Questions

- Are there hidden liabilities?

- Does the business require specialized skills you don’t have?

- Are there contracts that limit flexibility?

6. When to Dig Deeper

If the business passes the filters, proceed with a full due diligence checklist to confirm operational, legal, and financial integrity.

❓ FAQs: Quick Deal Reviews & Business Evaluation

1. Can a business really be evaluated in 5 minutes?

Yes. This method filters out unfit opportunities quickly, focusing your time on deals that merit deeper analysis.

2. What are the most important red flags to check?

Revenue decline, owner dependency, legal issues, and customer churn are top indicators.

3. How does this tie into AI workflows?

You can use AI tools to automate data collection, run financial summaries, and flag potential risks, making your 5-minute evaluation even faster.

4. Should I rely solely on a quick evaluation?

No. It’s a first pass. Always follow up with full due diligence and expert consultation.

5. How do I know if the deal is worth pursuing?

If it passes your quick filters and shows consistent performance without major red flags, it’s a candidate for deeper review.

6. Can I use prompts to assist this process?

Absolutely. AI prompts can help summarize financials, analyze industry trends, and generate a risk overview. Explore EJ’s prompt library for examples.

🤍 Soft CTA

Streamline your business evaluation process with EJ Bowen’s AI-assisted strategies. Visit the prompt library to discover tools, templates, and workflows that make deal analysis faster and smarter.